Navigating 1099-NEC Filing: Expert Insights from SAI CPA Services (Business Opportunities - Advertising Service)

USAOnlineClassifieds > Business Opportunities > Advertising Service

Item ID 2859018 in Category: Business Opportunities - Advertising Service

Navigating 1099-NEC Filing: Expert Insights from SAI CPA Services | |

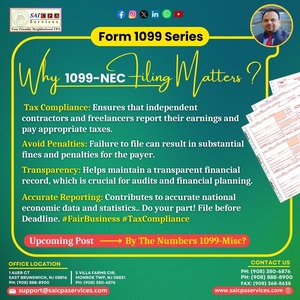

In the complex world of tax reporting, 1099-NEC filing stands as a critical compliance requirement for businesses. SAI CPA Services understands the nuanced challenges small businesses and independent contractors face. Why 1099-NEC Filing Matters: Legal Compliance Mandatory reporting for independent contractor payments IRS requires documentation for payments over $600 Ensures proper tax documentation and transparency Financial Accountability Helps track business expenses accurately Provides clear record-keeping for both payers and contractors Supports accurate income reporting Penalty Prevention Late or incorrect filing can result in significant financial penalties Fines can range from $50 to $280 per form Potential for IRS audits and additional legal complications Economic Reporting Contributes to national economic data tracking Supports accurate tax revenue collection Promotes fair business practices SAI CPA Services offers comprehensive support in navigating 1099-NEC filing complexities. Our expert team ensures: Timely and accurate form preparation Compliance with current tax regulations Minimized risk of penalties Don't let tax complexities overwhelm your business. Partner with SAI CPA Services for seamless 1099-NEC filing. Contact Us : Facebook: AjayKCPA Instagram: sai_cpa_services Twitter: SaiCPA LinkedIn: Sai CPA Services WhatsApp: Sai CPA Channel Phone: (908) 380-6876 (908) 888-8900 1 Auer Ct, East Brunswick, NJ 08816 #TaxCompliance #BusinessFinance #CPAServices #TaxReporting #SmallBizTips #Saicpaservices  | |

| Related Link: Click here to visit item owner's website (0 hit) | |

| Target State: New Jersey Target City : East Brunswick Last Update : Jan 24, 2025 2:30 PM Number of Views: 93 | Item Owner : Saicpa Contact Email: Contact Phone: +1 9083806876 |

| Friendly reminder: Click here to read some tips. | |

USAOnlineClassifieds > Business Opportunities > Advertising Service

© 2025 USAOnlineClassifieds.com

USNetAds.com | GetJob.us | CANetAds.com | UKAdsList.com | AUNetAds.com | INNetAds.com | CNNetAds.com | Hot-Web-Ads.com

2025-04-01 (0.404 sec)