"SAI CPA Services’ 2024 Tax Guide: File Smart, Save More!" (Business Opportunities - Other Business Ads)

USAOnlineClassifieds > Business Opportunities > Other Business Ads

Item ID 2887239 in Category: Business Opportunities - Other Business Ads

"SAI CPA Services’ 2024 Tax Guide: File Smart, Save More!" | |

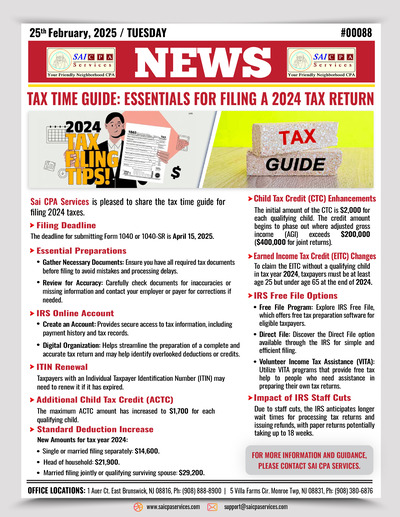

Tax season is here, and ensuring a smooth filing process is crucial for avoiding penalties and maximizing your return. At SAI CPA Services, we help individuals and businesses navigate tax season with confidence. Here’s what you need to know for filing your 2024 tax return efficiently. Key Deadlines & Preparations Filing Deadline: April 15, 2025 – Mark your calendar to avoid late fees. Organize Documents: Gather W-2s, 1099s, receipts, and tax-related records in advance. Verify Accuracy: Ensure your details are correct to prevent IRS processing delays. Maximizing Deductions & Credits Standard Deduction Increase: The new deduction is $14,600 for individuals and $29,200 for married couples filing jointly. Child Tax Credit (CTC) Updates: Claim up to $2,000 per qualifying child, with phase-outs for higher incomes. Earned Income Tax Credit (EITC): Eligibility criteria have been updated—check if you qualify. Filing Smarter with SAI CPA Services IRS Free File & Direct File: Explore free options for eligible taxpayers. ITIN Renewal: Ensure your ITIN is valid before filing. Proactive Tax Planning: Our experts help you reduce tax burdens and plan for financial success. At SAI CPA Services, we simplify tax season so you can focus on what matters most. Need expert assistance? Contact us today for stress-free tax filing! Contact Us : Facebook: AjayKCPA Instagram: sai_cpa_services Twitter: SaiCPA LinkedIn: Sai CPA Services WhatsApp: Sai CPA Channel Phone: (908) 380-6876 (908) 888-8900 1 Auer Ct, East Brunswick, NJ 08816 #TaxTime #SAICPA #2024TaxGuide #TaxFilingTips #FinancialSuccess #TaxPlanning #MaximizeRefunds  | |

| Related Link: Click here to visit item owner's website (0 hit) | |

| Target State: New Jersey Target City : East Brunswick Last Update : Feb 25, 2025 4:23 PM Number of Views: 90 | Item Owner : Saicpa Contact Email: Contact Phone: +1 9083806876 |

| Friendly reminder: Click here to read some tips. | |

USAOnlineClassifieds > Business Opportunities > Other Business Ads

© 2025 USAOnlineClassifieds.com

USNetAds.com | GetJob.us | CANetAds.com | UKAdsList.com | AUNetAds.com | INNetAds.com | CNNetAds.com | Hot-Web-Ads.com

2025-03-03 (1.060 sec)